Imagine this scene: a traveler steps off a 13-hour flight to Bangkok, exhausted and disoriented. But before they can mumble "where can I buy a SIM card?", their banking app chimes with a series of notifications:

"Welcome to Thailand! You're now connected with 2GB of data. Enjoy your trip!"

"Current exchange rate: 1 USD = 32.5 THB. Would you like to convert $200 to ฿6,500 at this rate?"

"Your card is ready to use. We'll automatically show prices in USD while you shop."

No hunting for airport kiosks. No swapping tiny SIM cards with jetlagged fingers. No seeking out currency exchange counters with questionable rates. Their banking app quietly handled everything mid-flight, creating a seamless arrival experience.

This isn't science fiction, it's happening right now across the fintech world. An unlikely convergence is underway as digital banks aren't just handling money anymore, they're keeping phones connected too. From Revolut in Europe to Nubank in Brazil, fintechs are aggressively jumping into the telecom business through eSIM offerings, creating an integrated travel experience that combines connectivity and currency in one place.

It raises a delightful question as travelers breeze through immigration: why on earth is my fintech app also my phone company?

The eSIM Revolution: Why Now? 📱

This whole convergence rides on a technology that's been quietly changing our phones: embedded SIM (eSIM).

Unlike the physical SIM cards we've fumbled with for decades, eSIMs are built directly into devices. Most recent iPhones and Android phones already have them, Apple even eliminated physical SIM trays entirely in US iPhone 14 models and beyond.

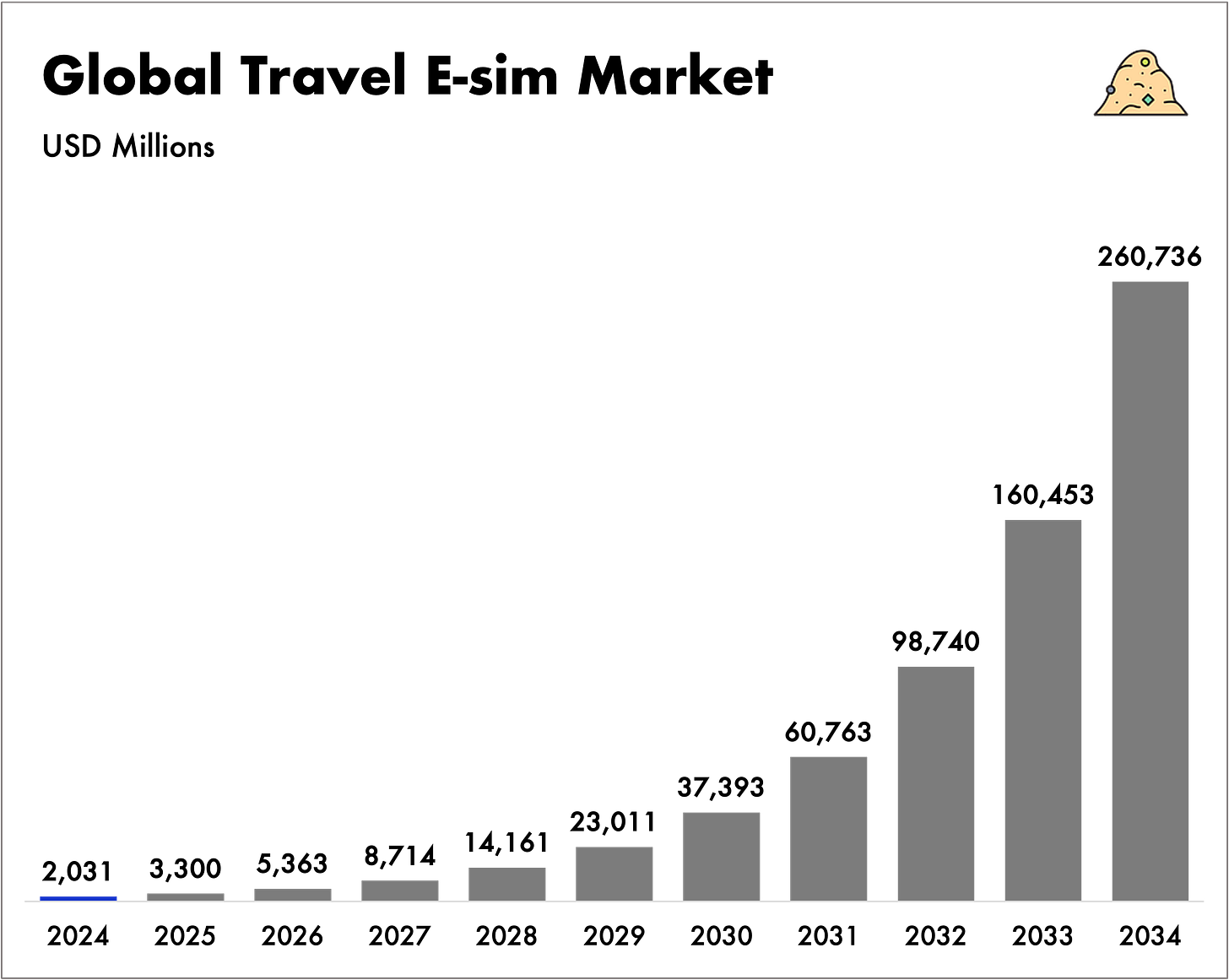

The numbers reveal a technology hitting its tipping point:

Nearly 600 million eSIM-equipped smartphones exist worldwide

Travel eSIM market size is projected to explode from around 2 billion today to 260 billion by 2034

But technology alone doesn't explain the timing. What's changed now is the emergence of "telecom-as-API" platforms. Companies like 1GLOBAL and Gigs have built infrastructure that handles all the messy backend work of telecom operations. Ten years ago, a bank offering mobile service would have been technically impossible due to enormous infrastructure barriers. Today? It's basically copying and pasting an API key.

This is the AWS moment for telecoms. Just as cloud computing made every company potentially a software company, these APIs are making every app potentially a telecom provider.

The friction is gone. The playground is open.

Why eSIM Is Fintech's Perfect Match 🔍

Fintechs have tried expanding into many adjacent spaces, from insurance to BNPL loans to carbon footprint tracking. So why has connectivity emerged as the clear winner? Three strategic factors explain this convergence:

Beefing up the Subscriptions plan 📦

Fintechs have long sought ways to deepen engagement and lock in recurring revenue. Over time, the subscription model has emerged not just as a monetization tool, but as strategic infrastructure, anchoring everything from premium cards to cross-border payments to insurance.

Mobile data plans fit neatly into this ecosystem. They're inherently recurring, immediately useful, and highly valued by globally mobile users. Embedding connectivity into financial subscriptions adds a tangible benefit that users instinctively understand, reinforcing the value of premium tiers.

The alignment between banking subscriptions and connectivity needs makes eSIM offerings a natural extension. A user who pays monthly for financial services is already primed to expect ongoing value; throwing in "3GB of global data monthly" makes the offer more concrete and compelling than nebulous perks like "enhanced fraud protection." In this way, mobile plans don't just complement the subscription model, they amplify its effectiveness.

2. The Travel Flywheel Effect ✈️

Fintechs have been assembling a "travel stack" for years:

Multi-currency accounts for forex

Premium travel insurance

Airport lounge access

Hotel and flight booking integrations

Adding eSIM is a puzzle piece that makes the whole machine spin faster.

Picture the journey: A traveler books flights through their banking app's deals, accesses the airport lounge with their premium card, lands with instant connectivity from the same app, then uses that app's card for local purchases. Each service feeds the next in a virtuous cycle, a flywheel generating more engagement, more data, and more revenue.

Smarter Security Through Location 📍

When your banking app provides your connectivity, it gains powerful contextual data: where you are, when you’re active, and your usage patterns.

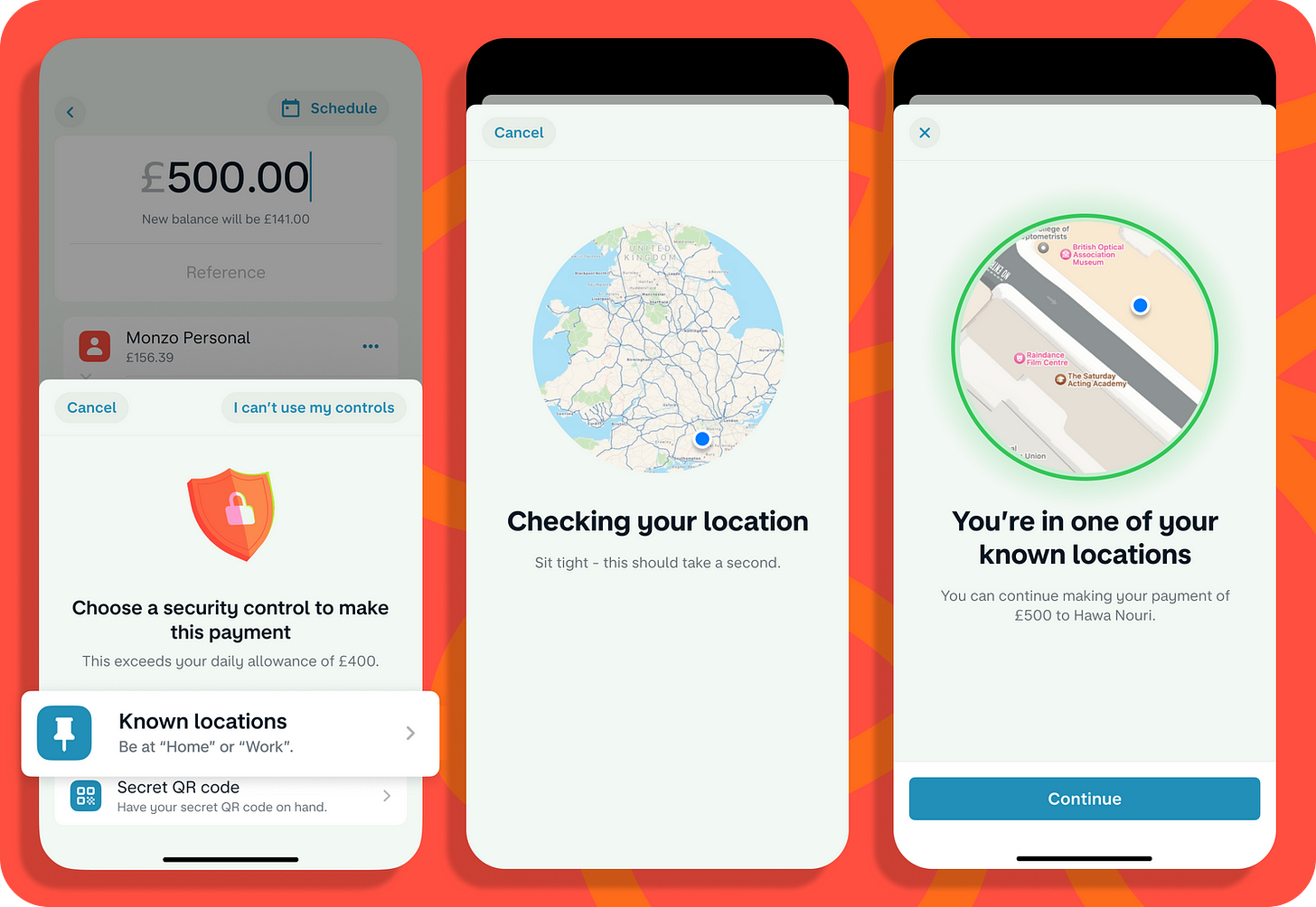

This location intelligence is a game-changer for fraud prevention. For example, Monzo’s “Known Locations” feature allows users to register trusted places, like home or office to authorize sensitive transactions based on GPS location. But with an integrated eSIM, fintechs can level this up even further. eSIMs provide reliable, carrier-verified location data, resistant to GPS spoofing or device tampering.

If a card is used in Paris but the user’s phone, confirmed by network-level connectivity, is clearly in São Paulo—that’s an instant, accurate red flag. Conversely, verifying that the device and card are present in the same country via cellular networks allows fintechs to significantly reduce false positives, providing a smoother, frictionless experience for legitimate users.

This direct access to trusted location signals eliminates reliance on third-party data, tightening security protocols and reducing unnecessary friction. It’s a win-win: stronger fraud protection for fintechs, and seamless experiences for users traveling abroad.

Global Pioneers: Who's Leading the Charge 🌎

Revolut: From Banking App to Full-Service Carrier

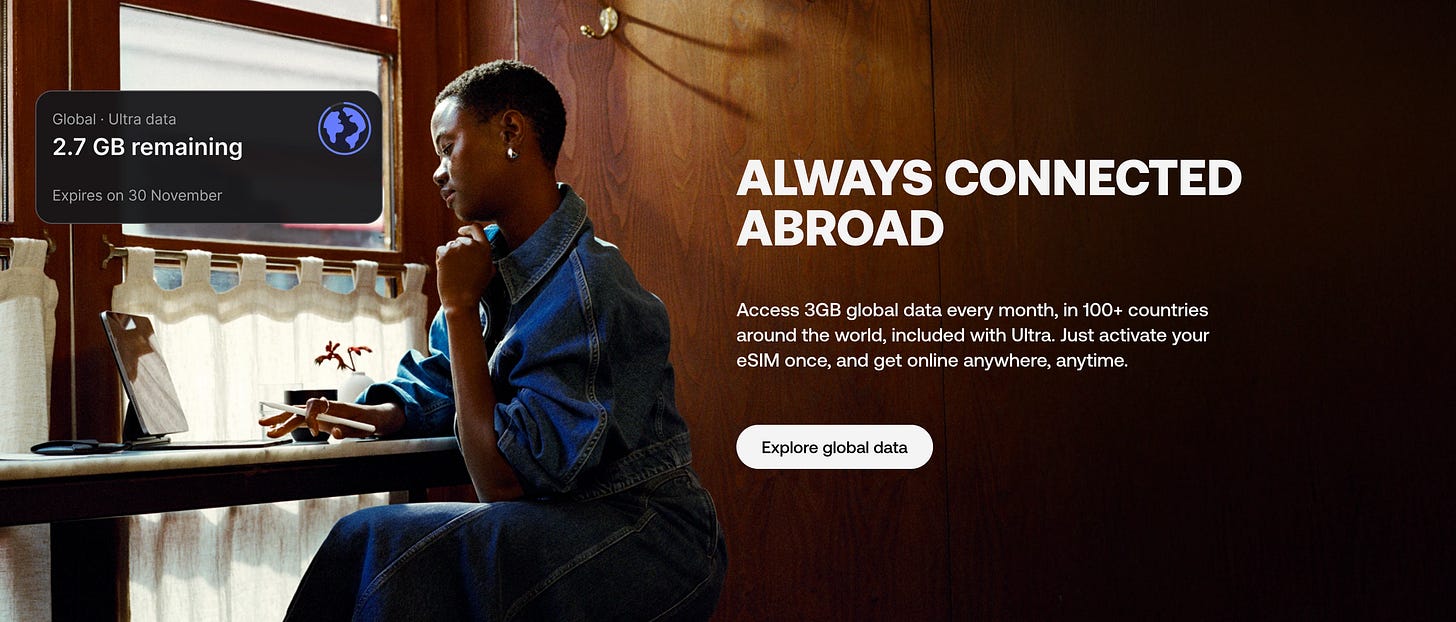

The UK-based fintech was among the first to integrate global eSIM. For about $55/month, Ultra plan subscribers get premium banking features plus 3GB of global data monthly, easily $30-50 worth of roaming data included "for free." According to its latest annual results, 600k customers purchased an eSim plan with the fintech in 2024. Not trival numbers at all.

But Revolut isn't stopping at data-only eSIMs. They're now expanding into full mobile plans with calls and texts in the UK and Germany, essentially becoming a full-fledged carrier. Their strategy is clear: test new markets with eSIM data plans first, then launch complete mobile services once traction is established.

The strategy is working. Revolut saw subscription revenue climb 74%, with paid subscribers surging 45%. Perhaps most tellingly, eSIM became their #1 non-banking product by usage. That's not just a feature, it's a growth engine.

Nubank: Connectivity as Premium Incentive

Latin America's largest digital bank has taken a different approach, focusing on using connectivity to drive premium account adoption.

Their Ultravioleta cardholders get a free 10GB roaming data eSIM annually, covering 195 countries. In a region where roaming data costs are prohibitively expensive, this perk carries significant value.

Nubank has created interesting synergies with their "NuCel" product. Beyond connectivity, customers gain access to an exclusive savings account with a 120% CDI return (substantially above typical rates) on deposits up to R$10,000 (US$1,748), guaranteed for at least one year.

This approach demonstrates how connectivity can be leveraged not just as a standalone feature, but as an entry point to a broader ecosystem of premium financial services.

The Roadblocks: Not All Smooth Roaming ⚠️

Fintechs diving into telecom is an exciting frontier, but there's more to this story than flashy announcements suggest. Revolut and Nubank's mobile connectivity plays face real challenges that make this marriage more complex than it first appears:

MVNO Dependency: Fintechs rely on established telecom providers (e.g., Vodafone, Telefónica, Verizon) for network access, which leaves them vulnerable to pricing pressure and limited control over technology and quality of service. Strategic negotiations and multi-carrier partnerships can mitigate, but not fully eliminate, this dependency.

Infrastructure Economics: And if fintechs are thinking of going direct, it then requires enormous upfront investments, billions in spectrum licensing alone, plus substantial network infrastructure buildouts. While this high barrier protects fintechs from extensive competition, it also permanently ties them to partnerships rather than independent control.

Operational Complexity: The minute you offer connectivity, you inherit telecom-level support expectations. "My internet won't connect in rural Vietnam" is a very different problem than resetting a card PIN. Poor service could damage the fintech's core brand.

The Next Frontiers: Where This Convergence Leads 🔮

As fintech-telecom fusion continues evolving, several exciting possibilities emerge:

Full Voice/SMS Integration: More fintechs could follow Revolut's lead into full-service mobile plans, complete with phone numbers and calling. This edges closer to complete convergence, more bank app might assign you a phone number in the near future.

Context-Aware Financial Services: The marriage of location and financial data enables predictive features. Imagine landing in Tokyo and a banking app immediately asks: "Want to convert ¥50,000 at today's rate?" Or it notices a booked flight to London next week and offers: "Shall we pre-load £200 and activate your UK eSIM?" This moves banking from reactive to proactive.

The End of Industry Boundaries 🧩

This isn’t just fintech trying on a new costume. It’s a genuine shift in what users expect from the apps that hold their money, and now their mobile identity. Banking and connectivity are fusing, not for novelty’s sake, but because it solves real friction at the exact moment users need it.

The best fintechs aren’t chasing telecom margins. They’re embedding connectivity to drive retention, improve risk, and create magical moments, like landing in a new country with your phone and money working in sync.

What used to be siloed services are dissolving into single, elegant experiences. The question isn’t “why is my bank a telco?” It’s “why wasn’t it before?”