Here’s the Answer

Researching is a core part of my work. Regulatory and licensing questions come up regularly, and getting them wrong has real consequences.

When I asked Google, I got ads for compliance consulting services, a legal blog from 2022, and several articles that discussed the laws generally but never specifically.

But Perplexity gave me a detailed answer in eight seconds, citing updated regulations, a fintech industry analysis, and specific licensing threshold changes. I could immediately verify everything against the source documents.

That's when Perplexity clicked for me. It's not just faster than Google, it's fundamentally different. Instead of giving me homework, it does the research and shows its work through citations.

This experience explains why 30 million monthly users have made Perplexity part of their workflow, and why the company just raised $100 million at a $18 billion valuation in July. But it also explains their core challenge: building something defensible when the underlying technology is increasingly commoditized.

The Founding Story: From Google Fan to Search Challenger

Aravind Srinivas had always been fascinated by Google. The 29-year-old AI researcher spent time at DeepMind and admired Sundar Pichai as a fellow Chennai native who'd made it to the top of tech. But by 2022, that admiration had evolved into something different: a conviction that he could build something better.

Traditional search was broken. Why click and sift when AI could read the web for you?

The timing turned out to be accidentally perfect. Knowledge workers were drowning in micro-questions—Slack threads full of "quick question" messages, Notion docs that needed one specific statistic, Figma comments asking for competitor context. The old ritual of opening a new tab, typing a search, scrolling past ads, and clicking through to sources felt increasingly clunky.

Google's results were getting noticeably worse, not because their algorithm broke, but because the economic incentives did. Every search is packed with more ads, more "People also ask" boxes, more featured snippets that answered adjacent questions. The "scroll to real info" tax was getting expensive for power users.

Srinivas left his research scientist role at OpenAI with a radical vision:

"Search should feel like direct memory access."

Instead of treating the web as a distant library, he wanted to treat it like RAM, instantly readable, available in real-time.

So in early 2022, he and co-founders Denis Yarats, Johnny Ho, and Andy Konwinski (seasoned crew from DeepMind, FAIR, and Berkeley) built a prototype and took it to Y Combinator's Winter '22 batch. The demo: AI that answers questions with cited sources, in plain language.

However, speed isn't a moat if GPUs are rentable. If your only advantage is doing what Google does but faster, remember that Google can simply throw money at NVIDIA to close the gap.

This tension, raw conviction versus the need for a moat, became Perplexity's defining challenge. By mid-2023, Perplexity's "direct memory access" dream was live. Users flocked. But the real work was just beginning.

The Core Hook That Worked

The foundation is deceptively simple: free search at perplexity.ai, augmented by Perplexity Pro at $20/month. You know the experience: type a question, get a cited answer in roughly 10 seconds. The UX feels like ChatGPT but with clickable footnotes that actually work

Under the hood, Perplexity does the Googling for you: retrieving web results, then summarizing via LLM magic. It's like a personalized Wikipedia entry generated on demand, plus follow-up suggestions to keep you exploring. The speed addiction is real. Complex multi-hop queries are resolved in 5-15 seconds.

Pro converts power users with faster responses, longer answers, and "Copilot" for conversational refinement. At $20/month—same as ChatGPT Plus—it targets the "premium unlimited" crowd. Even a 1% conversion of 30 million monthly active users (MAU) equals roughly 300,000 paying users, generating about $6 million monthly revenue.

But here's the uncomfortable truth: this is easy to clone.

The basic recipe is simple: search the web for relevant content, then feed that content to an AI model that writes a summary with citations. This approach, called "Retrieval-Augmented Generation" (RAG), is like having an AI research assistant that first gathers materials from the library, then writes you a report with footnotes.

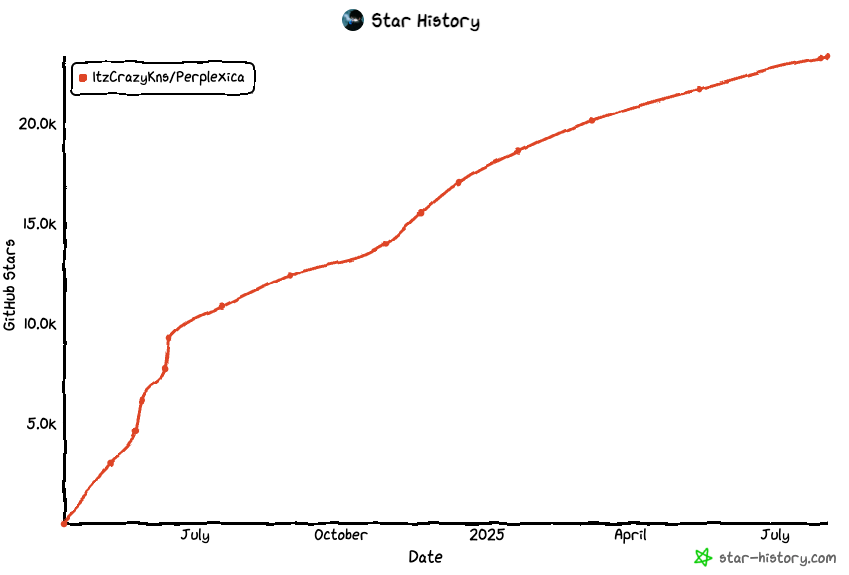

By mid-2024, independent developers released Perplexity-like systems using OpenAI's APIs and Google's search tools. One GitHub repo, cheekily named "Perplexica," nearly carbon-copied the experience with a few hundred lines of code. Anyone with basic programming skills and $50/month in API credits could build something remarkably similar.

The tech isn't a moat. Perplexity's edge comes from integration finesse and proprietary tuning earned over time. But fundamentally, retrieval-augmented Q&A is becoming commodity. Which brings us to their first big bet on defensibility.

The AI Browser Gambit: Building Moats Before Competitors Wake Up

Perplexity's boldest move was Comet, an AI-native browser they launched in early 2024, months before Google or Apple announced similar initiatives. This wasn't just feature expansion; it was a race to own distribution before the giants realized the threat.

Aravind calls it an "agentic browser", one that doesn't wait for clicks and typing but takes actions autonomously. The demo vision: tell your browser, "Find me a good Italian restaurant in SF and book a table for 2 at 7pm tomorrow." Instead of you navigating OpenTable, Comet's AI agent searches for well-rated spots, checks availability, and actually books the reservation, filling forms, handling confirmations.

The strategy was pure first-mover advantage. If Perplexity could establish Comet as the go-to AI browser before Apple Intelligence or Google's Project Astra matured, they might lock in distribution advantages that would take competitors years to overcome.

Still, the timing calculation made sense. Perplexity launched Comet when the giants were still treating AI as a feature, not a platform. Now that Apple and Google are racing to integrate AI into their browsers, Perplexity's early position in agentic browsing might be their most valuable asset.

The Enterprise Table Stakes

While consumer products grab headlines, Perplexity needed an enterprise offering to compete with ChatGPT and Claude, both of which now offer private data access for businesses. Think "Perplexity inside your firewall", companies feed internal knowledge bases into the system, and employees ask questions like "Where's the latest pricing strategy deck?" getting instant answers with citations from confidential files.

They launched Enterprise API and Perplexity for Business in late 2023, connecting to Google Drive, Confluence, and databases. Natural language querying replaces SharePoint search hell—a value proposition that enterprise buyers understand.

But this isn't really a differentiator anymore. ChatGPT Enterprise and Claude for Work offer similar capabilities, often with better model performance and broader feature sets. Perplexity's enterprise play is more about staying competitive than building moats, they needed to check this box to avoid being eliminated from enterprise evaluations.

The enterprise market does offer stickier revenue than consumer subscriptions, and Perplexity's search-specific focus might appeal to companies that prefer specialized tools over general-purpose AI assistants. But it's increasingly a commodity market where model quality and pricing matter more than specialized positioning.

Distribution: The Bundling Strategy

Here's where Perplexity shows genuine strategic insight. Instead of fighting Google head-on for search market share, they're pursuing distribution through partnerships and bundling, getting Perplexity into users' hands as value-added services.

Financial Services Bundling: Revolut offered Perplexity Pro as a perk to premium banking customers in 2024, seeding thousands of new users who wouldn't have paid otherwise. The bank gets a differentiated offering; Perplexity gets exposure to high-value customers who might convert long-term.

Telecommunications Partnerships: Several mobile carriers internationally are bundling Perplexity subscriptions with premium data plans. The logic is simple: carriers want to differentiate beyond speed and coverage, and AI-powered search feels cutting-edge enough to justify plan upgrades.

OEM Deals: Perplexity secured a partnership with Motorola to integrate their AI search into select smartphone models, a small but meaningful win that proves the distribution strategy can work. They're also reportedly in discussions with Samsung and Apple for broader integration opportunities.

It's the Google playbook (recall Google pays Apple $15+ billion yearly to remain iPhone's default search). Perplexity can't throw that cash around, but they can offer smaller OEMs "AI search" differentiation that helps justify premium device pricing, while potentially providing larger manufacturers with innovative features that distinguish their AI capabilities.

This distribution strategy acknowledges a hard truth: most users won't voluntarily switch from Google. But they might use Perplexity if it comes "free" with something they already value.

The Economics of Instant Answers

Perplexity's business model is both promising and precarious.

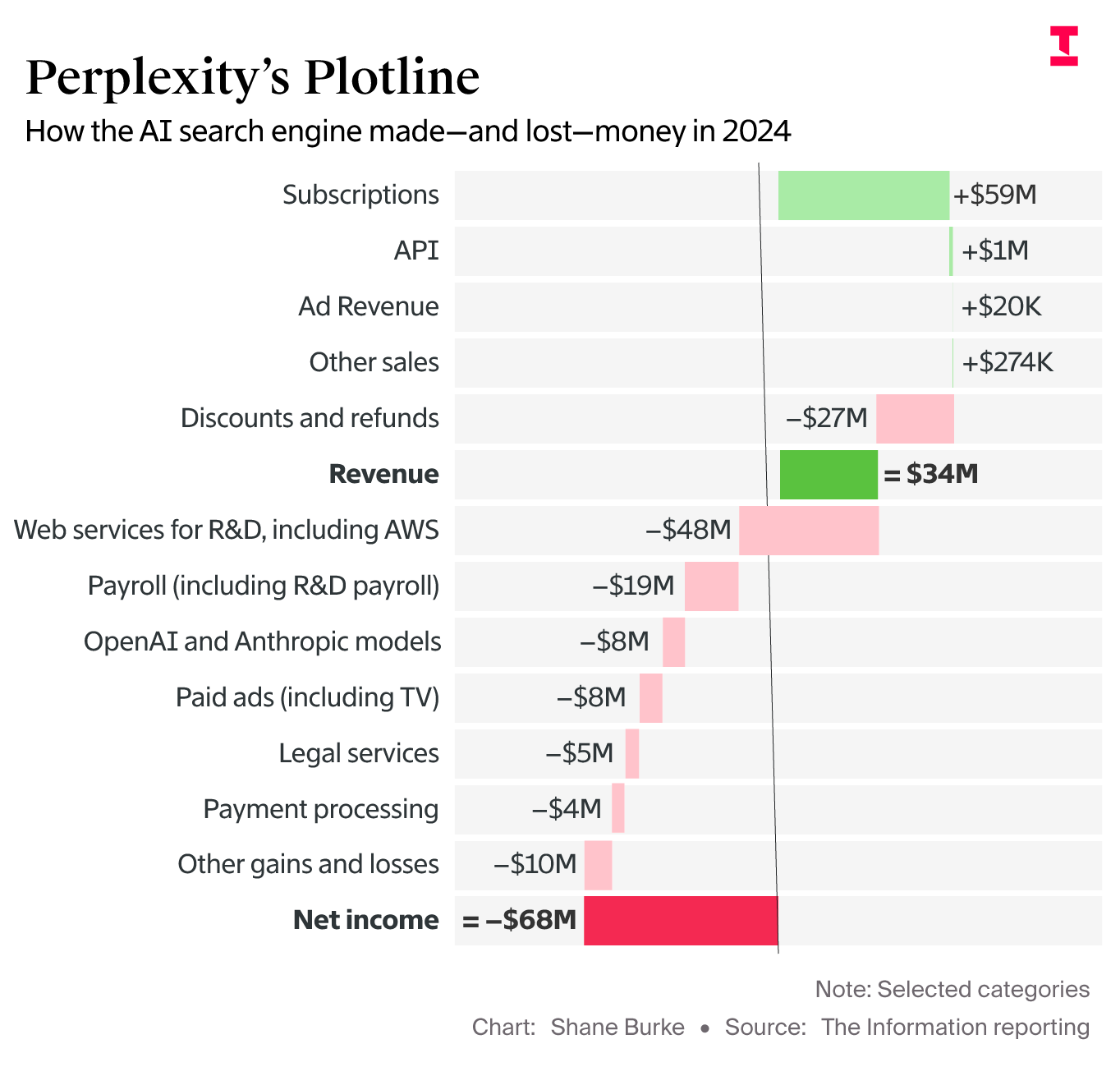

Start with the good news: Perplexity had cracked something that most AI companies struggle with, actual paying customers. With 260,000 people paying $20 monthly out of 1.6 million subscribers, they'd achieved a 16% conversion rate. For context, ChatGPT, with 500 million weekly users, only converts about 4% to paid plans. That's genuinely remarkable.

But here's where it gets complicated. The company generated $59 million in revenue but $27 million was spent (almost half) went to discounts and promotions, meaning they're essentially paying people to use their product through various distribution channels.

Perplexity claims healthy 57% gross margins, but there's an accounting sleight of hand here. They classify $33 million spent serving free users as "R&D" rather than cost of revenue, while companies like OpenAI count similar expenses as direct costs. It makes the margins look rosier than reality.

The fundamental problem is structural. Monthly expenses are expected to hit $12 million by August—20% higher than they forecasted. Every new user makes this worse, not better. When Google serves search results, it costs essentially nothing because they're pulling from pre-built indexes. When Perplexity answers your question, they're running expensive real-time computations while paying other companies for both the AI models and web data.

Perplexity is betting that AI will become so cheap that real-time answer generation becomes economically viable at massive scale. It might work. Or they might discover that some services are inherently expensive to deliver, no matter how much technology improves.

Google's Innovation Dilemma and the AI Awakening

Google's initial response to Perplexity reveals everything about why startups sometimes beat incumbents, even with inferior resources.

The Innovator's Dilemma in Action When Perplexity launched, Google could have easily built similar citation-heavy answers. They had better data, more AI talent, and infinite compute budget. But they faced a classic disruption trap: their existing business model couldn't support the new approach.

Google makes $150+ billion annually from search ads. Every time they provide a direct answer instead of a list of links, they potentially reduce ad clicks. Features like AI summaries create internal tension between user experience and revenue optimization.

Meanwhile, regulatory scrutiny meant Google couldn't radically overhaul search UX without triggering new antitrust concerns. Publishers were already suing over featured snippets. More aggressive AI answers would intensify those battles.

The Awakening But Google wasn't asleep—they were strategically constrained. By mid-2023, they launched Search Generative Experience (SGE), essentially their version of Perplexity's cited answers. The quality was comparable, sometimes better, but the integration felt half-hearted. AI summaries appeared only for some queries, often buried below traditional results and ads.

Now Google is accelerating. Project Astra promises more conversational search. Gemini integration makes AI answers more prominent. They're finally treating AI as platform, not feature, but they had to overcome organizational antibodies first.

The Competitive Reality Google's innovation dilemma gave Perplexity an 18-month head start to build user habits and brand recognition. But that window is closing. Google has superior data moats (owning YouTube, Gmail, Chrome browsing data), better AI infrastructure, and obviously better distribution.

The question isn't whether Google can build Perplexity-like features. They already have. The question is whether Perplexity can leverage their head start into durable competitive advantages before Google fully commits to cannibalizing their own business.

The Competitive Landscape

The other major threat comes from AI-first companies that own the underlying models powering the entire ecosystem.

OpenAI: The Platform Play OpenAI's ChatGPT added web browsing capabilities by late 2023, directly competing with Perplexity's core value proposition. Their advantage: they own GPT-4, the model that powers much of Perplexity's backend. They can offer similar functionality at lower marginal cost while funding development through ChatGPT subscriptions and API revenue.

OpenAI also has 100+ million monthly active users already trained to use conversational AI. If they perfect web search integration, why would users switch to a specialized tool?

More threatening still, OpenAI is rumored to be developing their own web browser, which would directly challenge Perplexity's Comet browser strategy. If OpenAI launches a ChatGPT-powered browser with native search integration, it could eliminate both of Perplexity's key differentiators, specialized search UX and browser distribution, in one move.

Anthropic: The Enterprise Angle Anthropic's Claude increasingly handles complex research tasks with web access. Their advantage: superior reasoning capabilities and growing enterprise adoption. Companies already paying for Claude might not need separate Perplexity subscriptions.

The Capital Reality Both OpenAI and Anthropic have raised billions specifically for model development and infrastructure. They can afford to price their web-enabled AI services aggressively to gain market share, potentially making Perplexity's business model unsustainable.

Perplexity's counter-argument: they're building the best user experience for search-specific tasks, while the AI giants are building general-purpose tools. Specialization might provide enough differentiation to justify premium pricing.

But this assumes users will pay for multiple AI tools rather than consolidating around one excellent general-purpose assistant. Early evidence suggests most users prefer simplicity over specialization.

The Future: Niche Player or Acquisition Target

Here's my honest take on where this heads, and why I think Perplexity faces an uphill battle for independent scale.

The Consolidation Thesis AI markets are likely to consolidate around a few dominant platforms rather than fragment across specialized tools. Most users won't subscribe to separate AI services for search, writing, coding, and analysis. They'll choose one primary AI assistant that handles everything reasonably well.

This dynamic favors companies with broad capabilities and deep pockets, OpenAI, Google, Microsoft, Anthropic, over point solutions like Perplexity. Even if Perplexity builds the best search experience, they're competing for share of wallet against platforms users already pay for.

The Distribution Disadvantage Google processes 8 billion searches daily with zero marginal acquisition cost. Apple controls default browser settings for a billion iPhones. Microsoft bundles AI search into Windows and Office. Perplexity needs users to actively choose their product over deeply integrated alternatives.

While bundling partnerships help, they don't solve the fundamental distribution asymmetry. Perplexity is fighting for attention against companies that own the operating systems, browsers, and platforms where most work happens.

The Acquisition Logic All this points toward two likely outcomes: Perplexity becomes a successful niche player serving specific power-user segments, or they get acquired by a larger platform seeking AI search capabilities.

Acquisition makes strategic sense for several potential buyers:

Meta: Needs AI search to reduce Google dependence for Facebook/Instagram information needs

Amazon: Could integrate Perplexity into Alexa for better question-answering

Apple: Perfect fit to supercharge Siri with citation-based search capabilities across their ecosystem

Microsoft: Hedge against OpenAI relationship risks

The Optimistic Scenario: The Google Memo is Right About Models

There's a strong bull case for Perplexity embedded in Google's "We Have No Moat" memo, but it requires reading between the lines.

The memo argues that foundation model advantages are ephemeral and expensive to maintain. Open source alternatives catch up quickly, making massive training runs poor investments.

This is potentially fantastic news for Perplexity, because they're not playing the foundation model game at all. While OpenAI and Anthropic burn billions training models from scratch, Perplexity post-trains existing models and competes on application layer innovation, citations, speed, search-specific UX.

If foundation models become commoditized, value shifts to building excellent products on top of those models. That's exactly Perplexity's strategy. They can adopt whatever open source models work best without legacy constraints, while companies like OpenAI must recoup massive training investments.

In this scenario, Perplexity's capital efficiency becomes a huge advantage. They can iterate faster, price more aggressively, and avoid the innovator's dilemma that traps companies protecting expensive model investments.

My Prediction I lean toward the consolidation scenario, but I'd love to be wrong. The AI market is moving too fast for definitive predictions, and Perplexity has consistently exceeded expectations.

Most likely outcome: Perplexity builds a sustainable business serving 20-30 million users who genuinely prefer their search experience. They generate $500 million - $1 billion annually from subscriptions and enterprise contracts. Eventually, they either accept acquisition from a strategic buyer or remain independent as a high-quality niche player.

Either outcome validates their approach, even if it doesn't achieve the Google-killer ambitions some investors envision.

What AI Founders Should Steal

Perplexity's journey offers crucial lessons for anyone building in the AI space, regardless of where they ultimately land.

Distribution Trumps Technology The best AI model in the world is worthless without a path to users. Think distribution from day one: bundling partnerships, integration opportunities, pre-install deals. Perplexity succeeded not because they had superior AI, but because they found creative ways to get in front of users. Pure technology plays rarely win without solving the go-to-market puzzle.

Focus Beats Features Resist the temptation to become an everything app. Perplexity succeeded by doing one thing exceptionally well, cited search answers, while competitors added kitchen-sink features. Specialization can beat generalization if you're significantly better at the core use case.

Model Commodity Defense Don't build a company that depends on exclusive access to superior AI models. Those advantages are temporary and expensive to maintain. Instead, build differentiation through user experience, data network effects, or distribution advantages that persist even when model capabilities converge. Perplexity's post-training approach proves you can win without owning foundation models.

The broader lesson: AI creates winner-take-most markets where a few platforms capture disproportionate value. Success requires either becoming one of those platforms or finding defensible niches within them. Perplexity chose the latter path, we'll soon learn whether it leads to sustainable independence or strategic acquisition.

Either way, they've proven that startups can still challenge tech giants by moving faster, focusing sharper, and building products users genuinely love. In an industry racing toward commoditization, those advantages matter more than ever.