NIUM: The McDonald's of financial services

The payments infrastructure provider is well positioned to capture a rapidly growing payment market.

The Origins: Why so expensive?

Prajit Nanu was in Thailand in 2013 to organise a memorable bachelor party for a close friend and everything seemed perfect until it was time to settle the bill for a villa. The resort refuses to accept his credit card and insists on a bank transfer. He quickly realised that the transfer fees alone would cost more than the actual bill. To make matters worse, the paperwork is a labyrinth of confusing forms and legal jargon.

Frustrated by the cumbersome and costly process, Nanu found a workaround by transferring money to an Indian friend living in Thailand, who then paid for the resort in Thai Baht. While this solution worked, it was far from ideal and got Nanu thinking: "There has to be a better way."

How about a simple and affordable platform for people to transfer money across borders, without the crazy expensive fees charged by the banks? In 2014, Nanu roped in his friend, Michael Bermingham, and Instarem was born.

From Instarem to NIUM

Nanu and Instarem's story is a classic entrepreneur story, near-death experiences, hard work and finally some level of success.

Nanu's business solved a clear problem but many similar startups were popping up during that same period of time solving the same exact problem. Competition was strong, and survival was not guaranteed. By 2015, just one year after Instarem was founded, they barely had enough money to last for 6 months. In a last-ditch attempt to drum up some interest in the firm and get the funding that the firm needed to survive, Nanu packed his bags and moved to Singapore. Within 2 months of moving, he managed to secure the US$5m funding led by Vertex Venture that kept the firm alive.

After surviving the near-death experience at the formative stage of Instarem, the firm went on to grow massively. By 2016, Instarem expanded its services to businesses and was estimated to be processing 150,000 transfers each month, for an average size of $1,800 per transaction.

However, Instarem was still not profitable. They were bleeding cash. In 2017, they were down to a cash runway of 5 months and urgently needed an infusion of cash. Vertex Ventures stood up again and did an internal round to fund the firm. Eventually, a chance encounter with GSR Ventures allowed him to raise a US$13m round for Instarem to not only survive but also to expand and scale up.

With the money raised, Instarem went on a global expansion. They did it with an approach to own all the infrastructure at the onset, acquiring the local money services business/e-money licences and connecting directly to the country's payment networks. This long-term strategy would prove to be an important thread that propels the firm's fate in the coming years.

Instarem expanded globally with 2 main products. A core Business-to-Consumer (B2C) remittance service and a nascent Business-to-Business (B2B) platform, aptly named 'MassPay,' designed to streamline bulk and customised payments for businesses.

By 2019, Instarem had the relevant payment licences in key countries & regions:

EU

Part of US

Australia

Canada

Japan

Indonesia

Singapore

Hong Kong

Malaysia

India (in 2021)

Launching its MassPay B2B platform and accumulating global payment licences eventually allowed NIUM to pivot. A pivot that made them who they are today.

In a strategic pivot in 2019, Instarem rebranded itself as NIUM, focusing on B2B solutions. Instarem will continue to operate as a wholly-owned consumer service remittance. The B2B NIUM platform builds on MassPay and now allows businesses to not only send but also spend and receive funds globally.

This platform is possible because of the firm's deliberate manner of acquiring payment licences as it expanded. Fintech companies and even established banks can now use NIUM's platform to issue cards, conduct payments and receive payment all without going through the hassle of acquiring the relevant licences.

The pivot worked. NIUM's revenue surged to US$82m in 2022 from just USD$7.3m in 2019. The firm also processed up to US$23b in transactions in 2022 up from merely US$1.5b in 2018.

After flirting with a public listing many times over the firm's history, this seems to finally be the moment when NIUM seeks out an IPO. Founder Nanu uprooted its family and moved from Singapore to San Francisco in late 2021 to prepare the firm for a listing in the USA by 2025.

With this goal in mind, NIUM has shifted its approach to pursue profitability which would be appealing to investors in a public listing.

The Products

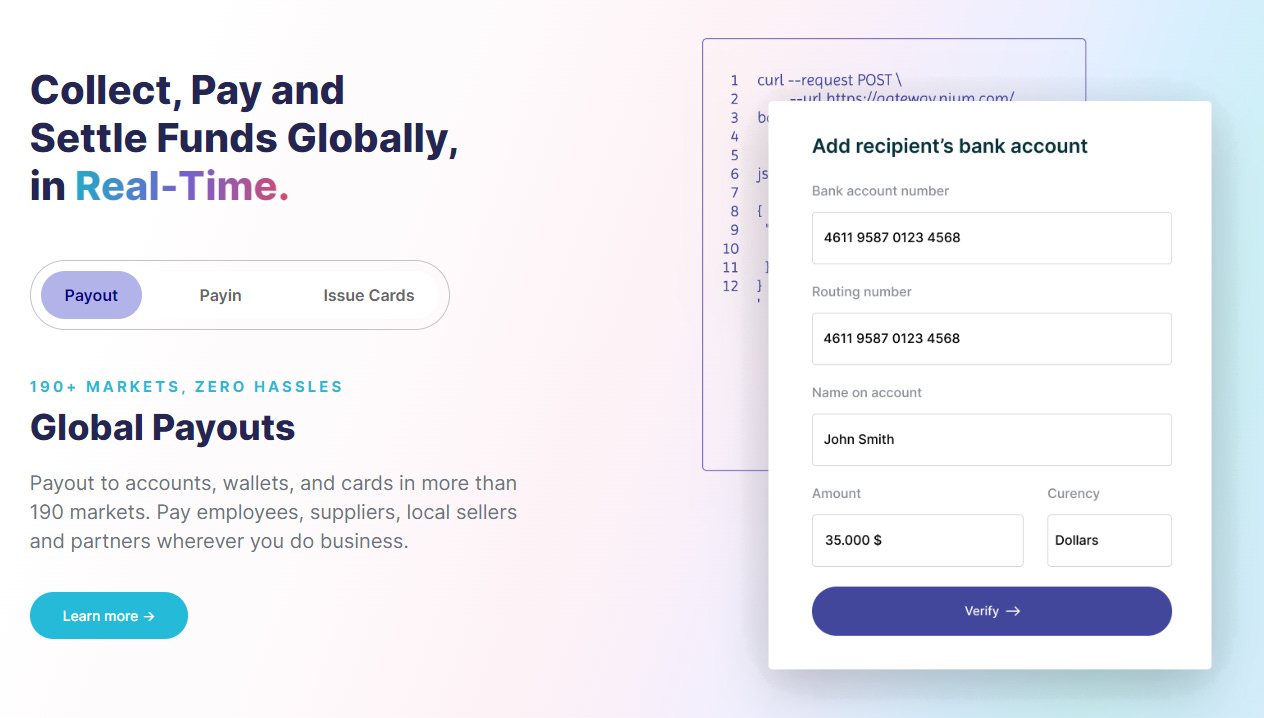

NIUM offers a very different set of products from when it first started. Today, it offers an API to its customers which will enable them to connect to a full suite payment infrastructure. Or in fancier terms a Banking-as-a-service (BaaS) provider. But does that really mean? Let's break this down.

Who Uses NIUM?

Before we begin on the products on NIUM, it is worth highlighting who their customers are. They consist of Fintech companies and Payment Service Providers (PSP), banks and corporates that wish to launch financial products.

Wish to launch a financial product? NIUM's got you covered. The ability to issue cards, receive payments and make payments is enabled by partnering with NIUM. This is a rare win/win solution for both NIUM and their customers.

Customers get the ability to launch their financial products without going through the time-consuming and expensive path of acquiring the relevant licences. These cost-savings are then passed down to their end users, who enjoy a cheaper fee for using such products.

NIUM also wins by monetising this virtuous loop. They engage in a profit-sharing model that will enable them to benefit if their customer does well.

The beauty of a single platform that reduces the complexity of financial products for its customers is a key reason why NIUM has managed to sign up many of Asia's largest customers. Aspire, Deel and Payoneer all count as NIUM's customers.

“Customers care about achieving a transaction, not on how the money is collected and processed.”

-Prajit Nanu

That is something that NIUM does very well.

The Product Suite

The landscape of business has gone global—your employees are in London, suppliers in Shenzhen, and customers in New York. The catch? You're juggling multiple currencies, and every transaction comes with a bite of fees and conversion rates. Sure, traditional banks offer cross-border services, but often at a premium. Fintech startups? They promise the moon but need to navigate a complex scene of local licences, translating to longer wait times and hidden costs.

Enter NIUM. Think of it as your global financial concierge. By partnering with them, you bypass the red tape and the legwork of acquiring local licences, a long and expensive process. NIUM has already done the heavy lifting.

NIUM offers 3 core products:

Global Payouts: Payouts to accounts, wallets, and cards in more than 190 markets.

Global Payin: Collect funds in multiple currencies from customers worldwide.

Card Issuance services: Global payroll, spend management, or travel companies with virtual card solutions. This is a particularly interesting feature, especially with the acquisition of Ixaris, a B2B Travel payments firm, in 2021. This acquisition allowed NIUM to target Online Travel Agencies (OTA) and strengthen their virtual card capabilities (a brief run-through as this is a use case that deserves a deep dive on its own).

Imagine a firm called Cool Co which is a fintech firm that wants to provide banking services to Small and Medium Enterprise (SMEs). For them to do this, Cool Co will need to:

Provide business accounts which would allow businesses to store and collect their funds

Allow companies to conduct payment services for payroll and other operating expenses

Also, provide corporate cards to their businesses so that businesses can manage and track expenses

The road to success, however, is not easy. Cool Co could slog through, obtaining payment licences country by country and brokering deals with card giants like VISA and Mastercard. Yet, each of those steps is a drain—on time, money, and focus.

Or… Cool Co can just work with NIUM and skip all of the time-consuming steps. By teaming up with NIUM, Cool Co bypasses the arduous licence slog and leaps straight into delivering pay-in and payout services. They've also got a fast track to issuing corporate cards, letting businesses manage expenses without breaking a sweat. This modular approach allows for nimble pivots and swift geographical expansion.

In the blink of an eye

Within payouts, there is a space called the mission-critical payments that need to happen on time, every single time, without error. Examples include payrolls and payments to suppliers. The speed of such payouts reduces the amount of time money gets locked in processing, increasing the liquidity management of the cash flow of businesses.

It is within this space that NIUM differentiates itself with speed. With its payment infrastructure, NIUM enables real-time payment (RTP) to almost 100 countries. Almost 70% of payout volumes in NIUM are conducted in real-time. Competitors like Stripe offer RTP but lack the coverage of NIUM and Airwallex does not yet offer RTP.

RTP is a rapidly growing market, according to NIUM, the RTP market is valued at $18bn and is expected to grow at a rate of 36% till 2030. If this comes to fruition, NIUM is well-placed to capture this.

Future

Global payments industry revenue is expected to reach US$3.3tn by 2026. This is a massive market that NIUM is serving and there is still so much space that they can grow into.

Expanding the empire

Today, NIUM's revenue is 45% in Europe, 45% in Asia and 10% in America. There are still untapped markets around the globe that have the potential to supercharge the next leg of NIUM's growth. Geographical expansion is very much on the mind of Nanu.

NIUM is moving into LATAM strongly with entities in Brazil and Mexico. They are looking to expand their licence portfolio by getting Brazil's payment institution licence, either through an acquisition or an application. Beyond LATAM, NIUM also has its eyes set on Africa in the near future. If the plan succeeds, NIUM will have a portfolio of licences in all continents of the world.

Every firm is a Fintech

In 2020, Angela Strange of venture capital firm, a16z proclaimed that every firm can be a fintech firm and offer financial services. We see that with Apple, and we see that with Grab, with the integration of some type of financial service or product such as payments into a non-financial offering.

This is called embedded finance and NIUM provides the exact service to power it. With the rising trend of embedded finance, every firm can be a fintech firm and every firm can be a customer of NIUM. Massive.

Building for a Few

The payments industry serves a wide range of customers and they have different use cases for using payment infrastructure providers. To be able to serve all customers will require an immense amount of resources and also risk giving the firm a lack of focus. For the next leg of NIUM's growth, they are cognizant of that and are niching down to scale up.

“We don’t want to build for many, we want to build for the few. We believe that building for the few will lead us to that $700m-900m revenue path over the next five years.”

-Prajit Nanu

These few high-growth industries identified by Nanu are the bank and fintechs, travel and digital platforms. By reducing the number of customers served, NIUM is moving up the market curve. As explained by Mike Vernal of Sequoia Capital, being aware of what type of customers you are looking to serve is a clarifying way to inform your sales strategy. NIUM can now focus on building a specific persona of customers and potentially deepen their relationship (and revenue) with these customers.

Execution of this strategy will be key to determining whether NIUM can achieve the 10x growth in revenue that Nanu is gunning for.

The Risks

Yes, NIUM has spent almost a decade building up a strong moat to defend against competitors that are looking to replicate what they are doing. But there is also a bear case for them. Their business model is not susceptible to churn, especially from their most successful customers. Expansion risk and more competitors angling for their slice of the pie are also something the team needs to be wary of.

Business Model Risk

NIUM's embedded finance services allow their customers to grow and scale up operations without directly owning the rails. However, for the most successful customers who have seen a product-market fit, this represents a variable cost to them that otherwise can be terminated. The effort spent to acquire the relevant licences in markets where revenue is proven might just be worth it for some of NIUM's customers, enabling them to cut NIUM out.

However, the payments industry is fragmented and still growing. As long as there are new fintech players entering the scene, there will be further demand for NIUM's services.

Competition

Much like how NIUM itself pivoted from a B2C to a B2B business, big remittance firms might replicate this exact playbook. Airwallex and Wise are already offering similar services as NIUM and they have an equally big portfolio of licences. Competition in this space is likely to get even hotter with payments giant Stripe's effort to ramp up expansion across Asia. With APAC accounting for ~40% of NIUM's revenue, the additional competition would be a key risk.

The good news is that there might be space for multiple players. In APAC alone, the embedded finance industry represents a market size of ~$300b. With a market this big, the opportunities remain for NIUM even with increased competition.

Geographic Expansion Risk

With 90% of revenue derived from Europe and Asia, they still have many wells of untapped opportunity globally. Nium's next leg of growth would be by expanding into other markets, and they have moved strongly into Latin America. Entities have already been set up in Brazil and Mexico.

Entering a new region presents fresh risks for NIUM, whether they choose to build out their own network or choose to acquire a firm instead. However, given NIUM's experience in geographical expansion over the years, this point might prove to be moot. Furthermore, Nanu plans to set aside just US$50m (half the annual revenue) for acquisitions of about 2-3 firms to aid in geographical expansion. This perhaps signifies that NIUM is not looking for a super aggressive entry into the LATAM market.

Regardless, a geographical expansion strategy over the next few years will likely see the burn rate of the firm increase, which brings us to the next point.

Burn Rate

Consider the burn rate as the financial heartbeat of a startup, a measure of how quickly a company is depleting its cash reserves without generating profit. It's the financial stopwatch that keeps ticking, monitoring how long a firm can sustain its operations before needing a fresh infusion of capital. When that timer nears zero, the urgency to secure additional funding or achieve profitability escalates, making it a critical metric for the health and longevity of the company.

In the history of NIUM, this stopwatch almost ran to zero twice. In both instances, the support of venture capitalists has allowed them to survive and continue growing. Until today, NIUM is yet to be profitable. Because they are a private firm, we have no real insights into their burn rate, or how long it takes for them to run out of money in the bank.

Given its geographical expansion strategy, there will be considerable expenses in terms of hiring, building infrastructure or acquisition of a new firm. This would increase the burn rate of the firm. However, I believe that this is something that was well planned out by the NIUM. In tandem with the geographical expansion, NIUM is also aggressively pursuing profitability, which can keep the burn rate constant or even reduce it as NIUM expands.

NIUM is doing that by being more targeted in acquiring new customers and narrowing its focus from offering to all to focusing on 3 high growth industries, Bank and Fintech, Travel and Digital Platforms. It remains to be seen whether this strategy would work but if successful, would drastically reduce the risk of running out of money.

Conclusion

In a rising payments industry gold rush, NIUM is the firm selling shovels and striking gold along the way. Having survived near-death experiences and fierce competition, NIUM has positioned itself as a dynamic force in a $3.3 trillion market.

Fueled by innovative solutions and a strategic focus on high-growth industries, the firm is not just navigating challenges but setting the course for the future of global payments. NIUM remains a firm to watch in this space.