Chime: Inside America’s Neobank for the Masses

Turning the under-served, over-looked majority into a growth engine

S1 Snapshot

Scale & Engagement: Chime serves 8.6 million active customers (Q1 2025), 67% of whom use it as their primary bank. Users average 54 transactions per month on Chime, a sign of deep, everyday engagement.

Financial Growth: 2024 revenue hit $1.67 B (up 31% YoY from $1.28 B) , and net loss shrank to just $25 M (from $203 M in 2023). They make $251 per active member, with an 88% gross margin.

Cost & Model: ~76% of revenue comes from interchange fees on card spending. By eschewing physical branches, Chime’s cost to serve is about a third of traditional banks, enabling a no-fee model without punitive charges.

Product Expansion: A broadening suite of offerings, from SpotMe fee-free overdrafts and Credit Builder cards to new Instant Loans and MyPay paycheck advances, drives cross-sell and loyalty.

Key Risks: Regulatory changes to interchange (Chime leans on a small-bank Durbin exemption), rising fraud/chargeback losses with new lending products , and heavy dependence on partner banks for FDIC-backed accounts all loom as challenges.

A Neo-Bank for the Masses

A young customer wakes up to a buzz on her phone: her paycheck landed two days early, courtesy of Chime. Rent is covered, groceries too, all before Friday. This small miracle has become ordinary for millions of Chime users. It’s a cinematic snapshot of Chime’s promise: banking that runs on human time, not banker’s hours. In 2025, that promise has turned a scrappy startup into America’s largest digital-only bank, preparing to ring the opening bell on Wall Street.

Chime’s rise poses a trillion-dollar question: Can a bank with no fees, no branches, and no gold-plated clients make money and remake banking? For years, big banks treated the paycheck-to-paycheck crowd as an afterthought, slapping them with overdraft fees and minimum balance charges. Chime flipped the script, betting that serving everyday Americans with empathy and technology could unlock a massive market. It built a community where getting paid early is standard, overdrafts cost nothing, and even credit is gamified, all while Chime quietly earns a slice of each swipe. The model succeeds when members trust Chime as their main account, so Chime has engineered every feature, and every quirk, to win that trust.

Now, as it files for an IPO, Chime stands at a crossroads of celebration and scrutiny. Its S-1 filing reveals breakneck growth and near-profitability, validating the fintech dream that upstarts can outmaneuver incumbents. Interchange fees, the tiny toll on every card transaction, have fueled Chime’s growth. But those same fees sit in regulators’ crosshairs, and rivals from Wells Fargo to Cash App are copying Chime’s moves. Chime’s big idea is now a big business, and the story of its IPO will hinge on whether that business can sustain its mission without losing its magic.

Origin Story

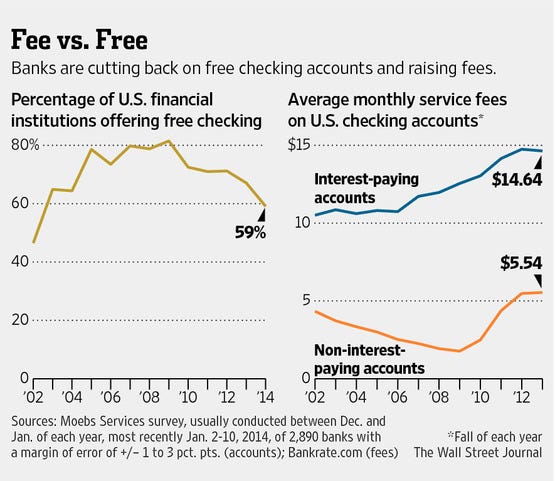

Chime’s story begins with a frustration and a vision. It’s 2012, and big banks are axing free checking accounts, Wells Fargo has just ended free checking for its customers.

Chris Britt, a product executive who grew up in a working-class New York town, sees a cruel irony: the people with the least money pay the highest fees. Britt cut his teeth at Green Dot, a pioneer in prepaid debit cards, where he discovered a powerful insight, if customers directly deposit their paychecks onto the card, they’d use it for virtually all expenses. In other words, make a financial product the center of someone’s income and you win their loyalty (and a stream of swipe fees). Armed with this insight, Britt sets out to build a new kind of bank.

In San Francisco, Britt is introduced to Ryan King, an engineer with a knack for building at scale in late 2012. The timing is perfect. Together, they imagine a mobile-first bank that doesn’t rely on punishing fees, but rather aligns with customers. By 2013 they co-found Chime, convinced that technology and clever economics can crack the riddle of serving the low-to-middle income segment profitably.

Early on, they faced skepticism. Traditional finance folks asked how “free banking” could ever make money. For the first few years, Chime grew quietly, proving its model on a small scale. The first product was a simple online checking account and Visa debit card, no monthly fees or overdraft charges, a stark contrast to the status quo. Britt insisted on a crucial hook: users had to set up direct deposit to unlock certain perks. It was a strategic gamble to become the primary account for users, not just a spare app.

Growth was steady, if not explosive, in the early years. The team hustled through early missteps (some features flopped, and skeptics abounded), but a turning point came as Chime allowed customers access to direct-deposited paychecks two days early, something that the banks would not have done, since it would cost them float (aka revenue).

Customers began referring friends in droves, driving out the cost of acquisition. By the late 2010s, Chime’s name started popping up whenever someone complained about bank fees on social media – there was always a fan ready to say “Try Chime.” Britt’s mission-driven mantra, serving the underdog customer, attracted investors as well. Forerunner Ventures’ Kirsten Green, known for spotting consumer trends, became an early backer and noted, “This is not a move-fast-and-break-things team’’, a nod to Chime’s careful approach in a fintech world sometimes prone to hype. Chime’s origin story isn’t a garage-to-IPO overnight legend, but a tale of persistence. It took a decade of refinement, trust-building, and staying true to the no-fee ethos, but Britt and King’s startup is finally ready to chime on the public markets.

Inside the Product Stack

Spending: Everyday Money Management

Chime’s product experience revolves around solving everyday money problems in a friendly way. Consider Spending: every Chime member gets a Spending Account (checking account) with a Chime Visa debit card. There are no monthly fees, no overdraft fees, and the app is designed to make managing money simple.

One flagship feature is “Get Paid Early”. Customers who set up direct deposit can automatically receive their paycheck up to 2 days early at no cost. It’s essentially a timing shift (Chime posts the deposit as soon as notification comes, rather than holding funds), but for someone living paycheck to paycheck, that early access can be life-changing. Around 90% of Chime’s members say it helped them avoid bank fees – a testament to how these small tweaks resonate.

The app also allows sending paper checks electronically (so you can pay a landlord or bill by mail through the app), filling the gaps of not having a brick-and-mortar bank. And for person-to-person payments, Chime offers Pay Anyone, a free P2P transfer feature that lets members instantly send money to friends (even if the friend isn’t on Chime yet). By covering the core spending needs, deposits, payments, bills, Chime positions itself as a viable central hub for daily finances.

Liquidity

Where Chime really innovated is in addressing liquidity crunches without leaning on predatory fees. SpotMe is the hallmark offering here, essentially a fee-free overdraft protection service. If an eligible member is short on funds, Chime will spot them up to a certain limit (originally $20, now up to $200) for debit card purchases or ATM withdrawals, with no overdraft fees. Rather than charging a $35 fee like a traditional bank, Chime covers the negative balance and simply recoups it from the member’s next deposit. Customers can even leave an optional tip for Chime if they want (a voluntary gesture, Chime doesn’t rely on it). Since launching SpotMe widely in 2019, Chime members have accessed a staggering $43.3 B in fee-free overdrafts through the program. SpotMe’s popularity peaks to Chime’s understanding of its users’ needs, when cash runs tight before payday, a $20 or $50 float can mean groceries on the table.

Chime then stretched this liquidity promise into short-term credit. MyPay, launched nationwide in July 2024, advances up to $500 of earned wages before payday at low or no cost; in its first eight months members drew $8.8 B. For larger gaps, Instant Loans pilot offers up to $1,000 for three or six months at fixed 6 %–36 % APR, still with no late fees or credit checks. Bundling SpotMe, MyPay, and Instant Loans gives users a continuum of liquidity, from a $20 grocery float to a $1,000 emergency, without traditional pain points.

While lending is new ground for Chime, it’s also the most profitable segment of consumer finance, a crucial step to reduce Chime’s reliance on interchange. The S-1 makes it clear that future growth will come from expanding these credit products.

Community

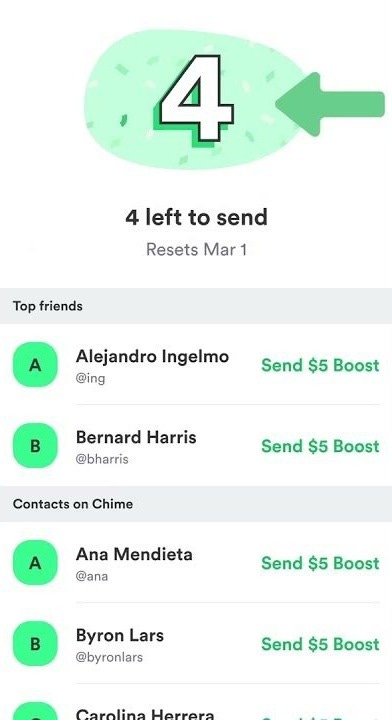

To amplify SpotMe’s network effect, Chime introduced SpotMe Boosts, a quirky social feature where members can temporarily boost a friend’s SpotMe limit by $5. Each month, you can send a Boost to someone in your circle (and they can send one back) as a way of saying “I’ve got you.” It’s a clever bit of gamification that turns a lending feature into a community sharing moment, and it subtly encourages friends to join Chime (after all, you can’t boost someone who isn’t a member). This social design makes banking feel a bit like a team sport, is one of Chime’s secret growth weapons.

Credit Building

Beyond immediate spending power, Chime helps users build credit and savings, without traditional barriers. In 2020, Chime launched the Credit Builder card, a secured Visa credit card that works differently from others. There’s no credit check to get one; instead, a user moves some money into a Credit Builder account, which becomes their spending limit. They can use the card like a regular credit card, and Chime reports the payments to credit bureaus to build the user’s score, but there are no interest charges or fees. Unlike a typical secured card, Chime doesn’t require a minimum deposit or sting you with annual fees. This product directly tackles the challenge many Chime users face, a thin or subprime credit history. By making credit-building idiot-proof (you can’t overspend beyond what you’ve “secured,” and there’s no interest), Chime has helped its members boost their FICO scores by an average of 30 points in six months. It’s both a social good and a strategic move: as members’ credit improves, Chime can keep them in the ecosystem for more advanced products down the line.

Savings

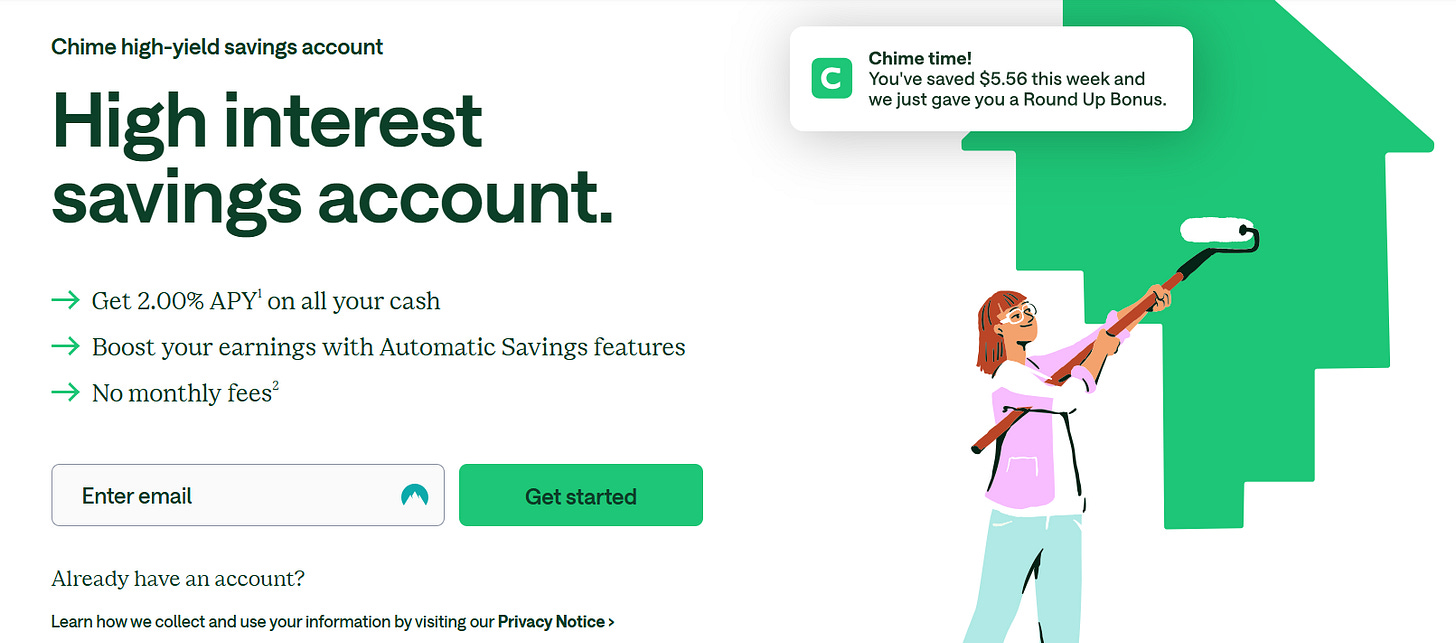

On the savings side, Chime offers a High Yield Savings Account that currently pays an attractive interest rate and includes automatic features like Round Ups (every debit card purchase rounds up spare change into savings) and “Save When I Get Paid” (automatically saving a percentage of each paycheck). These nudges helped many users, 85% of whom live paycheck-to-paycheck, to accumulate an emergency fund for the first time. All of these features come with zero fees or minimums, reinforcing Chime’s brand as the no-gotcha finance app.

Ecosystem Impact

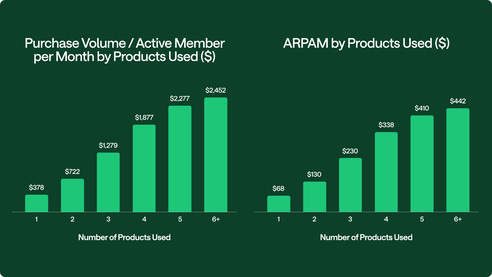

Spending, liquidity, credit building, savings, and community features form a unified experience inside a simple, emoji-rich app. An Active Member might pay bills from the Spending Account, use SpotMe for a quick float, tap MyPay for a mid-month advance, split dinner via Pay Anyone, grow a score with Credit Builder, and stash rounded-up change, all in one place. This breadth of usage is exactly what Chime wants: the more products a member uses, the more valuable the member.

Indeed, Chime’s data shows that a member who uses 6 or more features generates 1.8× the revenue (Average Revenue Per Active Member or ARPAM) and the spending volume of the average member, they stay longer, and refer more friends, creating a self-reinforcing growth loop.

ChimeCore: The Backbone Underlying Everything

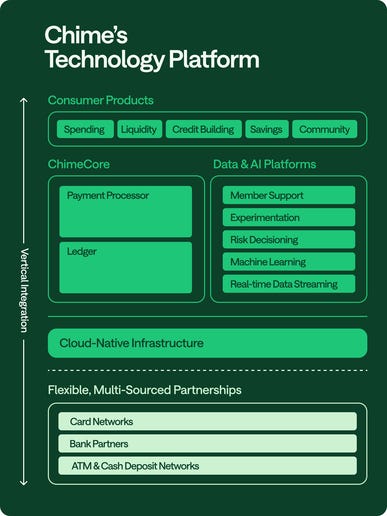

Anchoring every consumer feature is ChimeCore, the proprietary transaction engine launched in 2024. This cloud-native ledger and payment processor gives Chime full command of its stack, eliminating dependence on third-party cores. Tight control means faster product launches, real-time capabilities, and ultra-lean costs that let Chime keep fees at zero while scaling to millions. More than 600 engineers and 100+ payments-ops staff now run the backend in-house, enabling continual experimentation, AI-driven risk models, and instant data streaming. In essence, Chime is a fintech software company wrapped in a banking brand, and ChimeCore is the tech spine that powers the entire ecosystem above it.

Playbook & Economics

Revenue Engine – Interchange Engine

Chime’s business model is disarmingly simple: give banking services away for free, and make money on the margins. The lion’s share of Chime’s revenue comes from interchange fees, the small fee merchants pay (via Visa) whenever a Chime card is swiped. Every time a Chime member buys gas or groceries, Chime earns a percentage of that transaction (typically around 1-2% of the purchase) from the merchant. At scale, those pennies add up to hundreds of millions in revenue, in 2024 interchange-based “payments” revenue was about $1.28 B, or 76% of Chime’s revenue mix.

Crucially, Chime itself doesn’t charge its users any swipe fees; instead it leverages a regulatory quirk: because Chime’s partner banks are under $10 B in assets, they’re exempt from the Fed’s cap on debit card interchange. This Durbin Amendment exemption means Chime’s cards can earn a higher interchange rate than cards issued by giants like Chase or Bank of America. In essence, Chime legally earns more per swipe than the big banks do.

This interchange model aligns with Chime’s ethos: Chime only makes money when you use your account, not when you mess up. There are no monthly fees, no overdraft or minimum balance penalties sucking money out of users’ pockets. Instead, Chime’s incentives are to get users to swipe their card and stay active.

Operational Edge – Lean Cost Structure

To make this model sustainable, Chime relies on two key strategic levers: a radically low cost structure and a growth flywheel fueled by happy customers. On cost: Chime has no branches, a largely online customer support system, and a home-grown tech platform, all of which drives cost-to-serve per customer way down. An industry study found the average big bank spends over $400 a year to service a checking account; Chime spends about a third of that. When you’re not shelling out for marble lobbies and tellers, you can afford to not nickel-and-dime your users.

Chime even negotiated sweet deals with its vendors: as volume grew, it secured better interchange sharing terms with Visa and cut processing costs, so much so that cost of revenue actually decreased 6% in 2024 despite strong user growth.

That improved unit economics flows straight to the bottom line with gross margin hovering around 88 %, software-level economics traditional banks can’t match.

Member-Led Acquisition – The Referral Flywheel

The real magic in Chime’s playbook is how it turns customers into its marketing department. By building a product people genuinely love to recommend, Chime leverages word-of-mouth and virality to lower its effective customer acquisition cost ($109 per new active member). The S-1 reveals that members who use Chime deeply are far more likely to refer others. Features like SpotMe Boosts and referral cash bonuses (often Chime offers $100 for you and $100 for a referred friend after setting up direct deposit) have created a referral flywheel.

Cross-Sell Expansion: Beyond Interchange

Interchange funds the engine, but Chime is deliberately adding fresh revenue streams. “Platform-related” revenue, everything outside debit fees – grew 54 % YoY to ~$397 M in 2024, driven by MyPay wage advances, Instant Loans, higher interest yields on savings, and a rising mix of credit-card interchange via Credit Builder. The company’s data show that a member who uses six or more features produces 1.8× the ARPAM and 1.8× the spending volume of the average user, proving that every product launch deepens monetization while cementing loyalty.

Defensive Moat

Chime’s success forced megabanks to copy: Wells Fargo, Chase, and others now market early paycheck access and friendlier overdraft terms. That validates Chime’s thesis but shrinks its feature gap. The moat, however, is not just first-mover perks; it’s the combination of fanatical brand trust, a cost base one-third of branch banks, and social network effects baked into SpotMe Boosts, Pay Anyone, and community referrals. Those effects lower CAC each quarter, while the Durbin-exempt interchange keeps margins fat, an equation harder for incumbents to replicate than the features themselves.

Path to Profit

The playbook is no longer “grow at any cost.” When the fintech boom cooled in 2022, Chime laid off 12 % of staff, automated support, and tightened fraud controls. The result: net loss narrowed to $25 M in 2024 from $470 M two years prior, and the company logged its first profitable quarter in early 2024. In essence, Chime now marries a viral Silicon-Valley growth engine (low CAC, product-led referrals) with a high-margin, transaction-based revenue stack, demonstrating that fee-free banking can scale sustainably, at least as long as the interchange rules hold.

Competitive Landscape

Chime may be the frontrunner in digital banking, but it faces a pack of competitors. Each offers a twist on serving the modern banking customer:

SoFi - Upmarket Challenger

Originally a student loan refinancer, SoFi has evolved into a broad personal finance platform with banking ambitions. It even obtained a bank charter in 2022, allowing it to hold deposits directly and offer checking/savings alongside investments and loans. SoFi targets a more affluent, early-career professional clientele relative to Chime. Its edge is a full suite (stock trading, mortgages, credit cards) under one roof, and the ability to fund loans with its bank deposits. Chime competes with SoFi on checking accounts, but SoFi’s credit-heavy model and upmarket focus differentiate it. Notably, SoFi’s deposit base (over $10B) means it does face interchange fee caps, whereas Chime’s partners do not. SoFi’s challenge is achieving the same customer love in banking that it had in loans; Chime’s strength, its authentic brand with everyday folks, is hard for SoFi to replicate as it chases higher-end users.

Dave - Overdraft Rival

Dave is a fintech that built its name on tackling overdraft fees through small cash advances. For a $1 monthly membership (and optional tipping model), Dave lets users get up to ~$250 advance on their paycheck, a concept similar to Chime’s SpotMe and MyPay (indeed, Dave was an early inspiration for fee-free advances). Dave went public via SPAC in 2021 but has remained relatively niche, with a few million users. Its core users overlap with Chime’s segment (income often <$50k). Dave’s competitive weakness is that it’s mostly a single-feature app (the advance), with less of a full banking relationship; many Dave users still have traditional bank accounts and just use Dave for short-term help. Chime’s strategy of being the primary account means it offers far more daily utility than Dave. Unless Dave expands its product set significantly or partners up, it’s more likely to serve as a feeder or complement to platforms like Chime rather than a direct substitute. Dave’s existence, however, underscores the demand for liquidity products – something Chime recognized and built into its own ecosystem to prevent Dave or others from poaching its members.

Cash App - SuperApp Threat

Perhaps Chime’s most insidious competitor is not a “neobank” at all but the Cash App by Block (formerly Square). Cash App has over 50 million active users sending P2P payments, and many of those users opt for the Cash Card, a Visa debit card that lets them spend their Cash App balance in stores. In effect, Cash App has become a de facto bank for many, especially younger and lower-income consumers, without ever calling itself one. The Cash Card works very similarly to Chime’s debit card, even offering Boost rewards (discounts) at certain merchants. The convenience of tying into Cash App’s ecosystem (where users already receive money from friends or even paychecks) makes it a strong alternative to Chime. In Chime’s S-1, the company explicitly names Cash App as a direct competitor in the battle for accounts and payments. Cash App’s strength is its massive user base and the network effects of P2P payments (people use it because everyone else is on it). However, as a full banking replacement, Cash App has some gaps, it doesn’t offer savings interest, early direct deposit in the same way, or credit-building tools. Chime’s moat against Cash App is focus: by insisting that users commit (set up direct deposit, etc.), Chime fosters deeper engagement per user. Cash App, while huge, may have many casual or one-off users. Still, if Cash App’s generation of users stick with their Cash Cards, that’s potentially tens of millions who won’t need Chime. This competitive dynamic will be interesting to watch, as both companies vie to be the primary financial app on a smartphone.

Risks

While Chime’s story is uplifting, its S-1 makes clear the company is not without significant risks.

Regulatory

Chief among them is the regulatory risk around its interchange-dependent business model. Chime’s revenue engine could face a blow if laws change. The Durbin Amendment currently exempts small banks (under $10B in assets) from debit card interchange caps, and Chime’s partner banks enjoy that exemption. However, if regulators or Congress decide to tighten the rules and lowers interchange fees across the board or removing the small-bank carve-out, Chime’s economics would suffer. Lawmakers have floated ideas to cut interchange fees (pressured by retailers who pay them) and questioned whether fintechs are exploiting a loophole never intended for them. Though no immediate changes are imminent (and a divided Congress makes it less likely in the short term ), this overhang will persist. Chime acknowledges that more restrictive interchange regulations or even a reinterpretation of existing rules could “adversely affect” its business.

The company will have to keep a close watch on D.C. CEO Britt has been making frequent trips to Washington to advocate for the fintech model. In a worst-case scenario, if Chime were forced to become a bank to continue operating (losing its exemption unless it keeps partner banks under $10B each), it would entail significant cost and capital (a banking license could require ~$100M and heavy compliance overhead).

Fraud & Security

Another serious challenge is fraud and security as Chime scales its lending and payment services. The pandemic experience was a wake-up call: bad actors exploited Chime’s rapid growth, leading to $650M in fraudulent funds being funneled through accounts and later clawed back. Chime had to tighten onboarding and transaction monitoring, but fraud is an evolving battle. The S-1 warns that as new products like MyPay and Instant Loans grow, transaction losses will likely increase. Indeed, after launching MyPay in 2024, Chime’s transaction margin took a hit from higher write-offs.

The company must continuously calibrate its risk models, which leverage AI and lots of member data, to distinguish legitimate use from abuse. There’s also the issue of chargebacks and disputes. Chime members use its Visa cards everywhere, and when a fraudulent purchase occurs or a customer disputes a charge, Chime often eats the loss under its agreements with partner banks. These dispute losses can stack up, especially if fraud spikes or if Chime’s relatively less affluent user base has higher default rates on advances. Any major wave of fraud or defaults (perhaps during an economic downturn) could impact Chime’s financials and hurt its reputation. The company has invested in a “new risk officer, machine learning models, and dedicated teams” to combat this, but staying a step ahead of criminals is an ongoing cost of doing business in digital finance.

Partner Dependency

Chime’s dependency on third-party partners is another risk factor woven throughout its filing (See Synapse x Evolve fiasco). Unlike a bank that owns the full stack, Chime relies on a web of partners: Bancorp Bank and Stride Bank hold customers’ deposits, another network of banks participates in Chime’s savings sweep program (to spread out deposits for insurance coverage), and card networks/processors handle transaction flow. This introduces counterparty and concentration risk. If one of its key bank partners faces regulatory trouble or fails, Chime’s service could be disrupted and customer trust shaken. There’s also a volume limit consideration: if Chime’s growth pushes a partner bank over $10B in assets, that partner would lose the interchange exemption, hurting both parties. Chime expects to manage this (possibly by adding more partner banks or balancing deposits), but it’s a unique juggling act fintechs like Chime have to perform.

Next Act

Beyond its public debut, what does the next growth story look like for Chime?

Moving Upmarket

The next goal is to make Chime the primary bank account for Americans earning up to $100k. That implies moving upmarket to moderately higher-income users (who typically have existing bank relationships). To woo them, Chime may emphasize convenience and benefits over just fee avoidance, because someone earning $80k might care more about better yield or investing options than escaping a $12 monthly fee.

On that front, Chime has signaled plans to delve into investment and retirement products. Britt has openly discussed offering retirement accounts and ETFs through Chime in the future. This could mean an in-app brokerage or robo-advisor, allowing users to start investing small amounts or open an IRA. Such features would extend Chime’s lifecycle with customers as their financial needs grow beyond basic banking. It aligns with the trend of fintech “super apps” and would pit Chime against the likes of Robinhood, Cash App (which offers Bitcoin and stocks now), and SoFi’s investment platform. The challenge will be doing it in a Chime-y way, simple, low fee, and targeted to novices. But if successful, Chime could capture more of the ~$1 trillion in assets that its target demographic will accumulate as they age.

Expanding into adjacent segments

Another growth vector is tapping into adjacent demographics like teenagers and small businesses. Chime is currently only for adults, but a teen account (with parental oversight) could be a natural expansion. Rival Current proved the appetite by signing up teens and getting their parents to load allowance money on debit cards. Chime could similarly allow its existing members to create sub-accounts for their kids, teaching the next generation to “bank the Chime way.” This both grows users and cements family loyalty (parents might stick with Chime if their kids are on it too). In the small-business realm, many Chime users are gig workers or side-hustlers who might appreciate simple business checking accounts or invoicing tools.

A Chime for Business account, even if just a basic account under an LLC or sole proprietor’s name, could capture users who currently outgrow Chime and migrate to business banking elsewhere. It’s a logical step given how many Etsy sellers, rideshare drivers, and freelancers probably already use Chime for personal finances. Chime hasn’t announced this explicitly, but analysts often speculate that the SMB segment (for very small businesses) is low-hanging fruit once you’ve won the consumer’s trust.

As a public company, Chime will be under pressure to answer the question: what’s the path to being a full-fledged financial institution of the future? Will it remain partner-reliant, or eventually take on a charter? Britt has thus far preferred the partner route, but if Chime’s deposit growth pushes partners near the $10B cap, Chime might consider buying a small bank or getting its own charter to safeguard its economics. That would be a major strategic shift, essentially transforming into a bank holding company, and it’s something to watch in the few years post-IPO. For now, the simpler approach is to add new verticals (investing, insurance, etc.) on top of the partner-bank foundation.

Chime’s future outlook is about evolution, not revolution. It has built a powerful brand and base by solving fundamental problems for everyday consumers. The next chapter involves taking those consumers further on their financial journey, helping the renter become a homeowner (perhaps one day offering mortgages?), helping the credit newbie become creditworthy (maybe offering auto loans or bigger lines), and helping the saver become an investor. All the while, Chime will aim to keep its reputation for fairness and simplicity. If it can execute, Chime could transition from being “my first bank account” for many into “my only bank account,” and perhaps even the bank for their kids, their side business, and their retirement too. That’s a long game, but Chime’s IPO will give it the capital and clout to try and make it happen. The fintech revolution it helped popularize is maturing, and Chime’s task is to prove that a mission-driven, fee-free model can mature with it, delivering not just growth, but sustainable value to customers and shareholders alike in the years ahead.